Our bridging loans in London provide short-term property finance for purchases, refinancing and time-sensitive transactions. If you’re searching for bridging finance London, our team can assess your case quickly and advise on next steps

Contact Your BDM for Bridging Loans in London

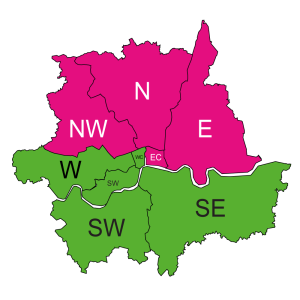

Areas we cover across London

We provide bridging loans in London for time-sensitive purchases, refinancing and investment opportunities across the capital. Whether your property is in Ealing, Hackney, Mayfair, or Wimbledon, our team supports brokers and borrowers throughout Greater London.

Common areas we cover include Islington, Camden, Westminster, Kensington & Chelsea, Hammersmith & Fulham, Wandsworth, Lambeth, Southwark, Tower Hamlets, Greenwich, Lewisham or Barnet and more.

Leave us a message

Product Information

- Loan Size: £100,000 – £50 million on standard bridging loans, no max. loan amount on Bridge Fusion

- Locations Covered: All 32 boroughs of London and Greater London

- Short-term terms: 3 to 24 months (+ 12 month extension, product-dependent)

- Security: Residential, commercial, mixed-use

- Interest Options: Retained, rolled-up, or serviced

- Speed: Indicative terms with 4 hours, funding within days

- Exit Strategy: Property sale, refinance, asset disposal, or business income

- Credit Flexibility: Poor credit considered

Why Us for Bridging Finance in London?

- Speed: Our bridging finance is fast. Receive terms in hours and funding in days. Ideal for auction deals or chain breaks.

- Tailored lending solutions: Every loan is bespoke. We adapt our terms to suit your deal, property type, and exit strategy.

- Complicated real estate welcome: From multi-unit developments and portfolios to title issues, we’re known for finding a way forward.

- Speak to an underwriter: Deal directly with your dedicated underwriters who understand the pressures of the London market.

- Trusted bridging lenders in London: We’ve helped countless clients, from solo investors to large-scale developers, navigate London’s competitive landscape with confidence.

Latest Case Studies

A Bridge Fusion Solution for a Property Investor With a Complicated Background

Read case studyA Complicated Commercial History Requires a Focused Refinancing Solution

Read case studyA Foreign National Requires a Large Facility to Keep Refurbishment Plans Afloat

Read case studyA HNW Individual Needs Funding for Two Very Different Investments

Read case studyA Semi-Commercial Catch-22 Requiring a Bespoke Solution

Read case studyAcquiring a New Property in a Buoyant Property Market

Read case studyAcquiring Prime Central London Property, With Speed and Transparency From the Offset

Read case studyAdapting to An Uneven Mixed-use Property Investment: Tips & Strategies

Read case studyAddressing How a Shortfall Would Be Covered for a BTL Investment

Read case studyAddressing Red Flags for a Foreign National Investing in the UK BTL Market

Read case studyAdjusting to a Borrower’s Changing Circumstances with Bridge Fusion Funding

Read case studyAssisting a First-Time Landlord with a Commercial Investment

Read case studyAuction Finance for Property Investor’s Reactions to New Local Authority Legislation

Read case studyAuction Property Finance Needed After the Deposit Was Paid

Read case studyBack Up Exit Strategies and Unearthed Arrears in the Legal Stage

Read case studyBalancing a Foreign National’s Financing Priorities

Read case studyBridge Fusion Premier Finance to Help Streamline a Landlord’s Portfolio

Read case studyBridge Fusion Solutions for Major Developments in the Commercial Market

Read case studyBridge Fusion Support for a Mixed-Use Property Bought at Auction

Read case studyBridging Finance to Help Organise Potential Inheritance Issues

Read case studyBridging Finance Unlocks Part-Tenanted Commercial Opportunity at Auction

Read case studyBridging Solutions for Short-Lease Investment Opportunities

Read case studyBridging the Gap for a Landlord in Financial Distress

Read case studyCapital Delivered to Cover Existing Facilities and Outstanding Debts

Read case studyCommercial Bridging Finance for an Investor Targeting a Burgeoning Industry

Read case studyCommercial Property Investors Don’t Need to Be Held Back by a Few Bad Financial Years

Read case studyCovering an Existing Charge While Also Investing In a Commercial Property

Read case studyCreating a Contingency Plan for a Protracted Conversion Strategy

Read case studyBridging Loans London –

What you need to know:

What is bridging finance and how is it used in London?

Bridging finance is a short-term loan used to “bridge” a financial gap – typically between buying a property and securing long-term funding or selling another asset. In London, it’s commonly used as auction finance for purchasing auction property, fast acquisitions, or to fund refurbishments in high-demand boroughs like Islington, Paddington or Hackney where delays can result in missed opportunities.

Why is bridging finance especially popular in the London property market?

London’s property market is one of the most competitive and fast-moving in the world. Traditional lenders often can’t keep up with the pace of deals, especially at auction or in chain-break situations. Bridging loans provide a vital tool for investors who need quick access to capital to act on time-sensitive opportunities.

We can provide bridging finance for property investments in any London borough in as little as 3 days. No matter if you look to purchase a property in Central London, refurb an auction property in North London or look for a development exit loan in East London, we can tailor our bridging loans to your circumstances, so you don’t miss out on London’s opportunities.

Can bridging loans in London be used for both residential and commercial properties?

Yes. Our bridging loans cover residential, commercial, and mixed-use properties. Whether you’re acquiring a luxury flat in Paddington or redeveloping a commercial space in East Finchley, we can structure a loan that meets your timeline and project goals. We also support conversions and change-of-use projects.

Do you offer auction finance for purchases in London?

Absolutely. Many of our London clients use bridging loans to secure properties bought at auction, where completion is required within 28 days. We can act very quickly due to short communication ways, ensuring you can complete without delays.

How important is credit history when applying for a bridging loan in London?

We’re a flexible lender. While we consider credit history, it’s not the only factor. We focus more on the quality of the asset, your experience, and a viable exit strategy. Even with adverse credit, if the deal stacks up, we can often still proceed.

What types of projects are typically funded with bridge finance in London?

Bridge finance in London is used for various purposes including: chain break solutions, auction purchases, refurbishments (light or permitted), commercial acquisition, or capital raising. Whether it’s a buy-to-let flat in Hackney or a development project in Haringey, we can help.

What makes Markt Financial Solutions different from other bridging lenders in London?

Our personal approach and deep understanding of the London market set us apart. You’ll deal directly with experienced underwriters who work fast, ask the right questions, and build deals that make commercial sense. We also welcome complicated, time-pressured, or non-standard applications and will always try to find a way to lend, rather than not.

What areas of London do you cover?

We cover all London boroughs and Greater London – from central zones like Paddington, Islington, and Southwark to outer areas like Chingford, Merton, and Norwood. Whether you’re investing in a prime postcode or an up-and-coming suburb, we can provide tailored funding that reflects local dynamics.