Q4/23 Report

The UKs empty buildings: How can we tackle the issue?

Despite an accute housing shortage, we’ve seen an increase in empty residential & commercial properties. In our report, we surveyed the public’s experience with vacant buildings, their views on how the government handles the issue & what we sould do to solve it.

Get your free Report with additional infographics below.

The UK’s empty buildings: How can we tackle the issue?

There has been a clear and accelerating rise in the number of empty residential buildings in England. The figure has grown by 24% in the last six weeks alone, according to recent analysis.

On top of this, the shift to hybrid and online working since the pandemic, coupled with higher interest rates, has resulted in declining demand for commercial property. Offices in the UK have taken the brunt of this damage. As a result, the number of commercial properties that are now sitting empty is also on the rise.

The prevalence of empty buildings across the UK – both residential and commercial – comes amidst a perennial, nationwide shortage of housing. As such, the issue of what to do with these empty buildings is of utmost importance across both the public and private sectors.

To delve into the UK’s empty building headache in greater detail, Market Financial Solutions (MFS) commissioned an independent survey of 2,000 UK adults.

In this report, we explore the findings of this research, revealing the public’s experience of empty buildings in their local area. The study also examines people’s faith in the government’s handling of the issue, and how they would ideally like to see empty properties utilised in the future.

Key findings at a glance…

Between 27 and 31 October 2023, an online survey of a nationally representative sample of 2,000 UK adults was carried out on behalf of MFS.

The prevalence of empty buildings

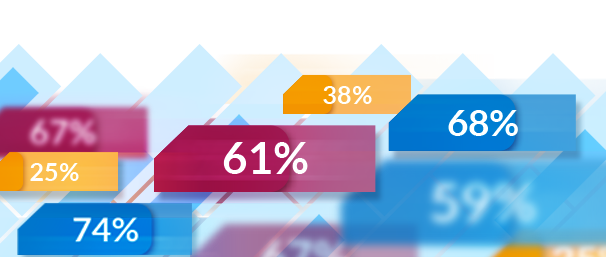

- 25% of UK adults said there are more empty or derelict houses on the street they live on compared to five years ago

- 38% said there has been a rise in the number of empty or derelict commercial properties on their local high street in the past five years

Government response and regulations

- 67% feel the government should do more to incentivise people to buy and renovate derelict and empty properties

- 61% think there should be stricter regulations to prevent people from leaving their property vacant or derelict

- 63% say that putting empty buildings back onto the property market would be the most effective way of solving the UK’s housing shortage

How to best use empty properties

- 74% are in favour of making empty properties available as new residential properties

- 68% would support derelict buildings being destroyed and the land to be used to create community spaces (such as parks, playgrounds, and allotments)

- 59% think empty properties should be converted into schools and nurseries

- 51% would like to see the buildings turned into more shops and hospitality venues

The prevalence of empty buildings in local areas

In the residential property sector, the growing number of empty homes is an increasingly important issue. To accompany National Empty Homes Week 2023 earlier this year, analysis by Leeds Building Society revealed there are more than 670,000 empty homes in England at present.

According to this research, this represents an increase of over 23,000 (3.6%) in the last 12 months alone. What’s more, around 248,000 of these properties have sat empty for more than six months – an increase of 4.8% compared to last year.

On the commercial property front, the data is similarly revealing. Even before the rise of hybrid working and a drop in demand for commercial property, statistics by Glide indicated there were 172,217 commercial buildings sitting empty at the start of the pandemic.

Furthermore, with interest rates and the cost-of-living crisis subduing consumer spending and, in turn, impacting upon the retail and hospitality sectors, there has also been a decline in the demand for commercial and business units.

This adds to the challenge. According to analysis from earlier this year, for example, local authorities owned 7,000 commercial and business premises across England, Scotland and Wales that have been vacant for more than a year.

With this data in mind, it is clear that the UK has an empty building problem – and this sentiment is clearly reflected in MFS’s research.

Indeed, of the 2,000 respondents, one in four (25%) said the number of empty or derelict homes on their streets seemed to have increased in the past five years. Meanwhile, a majority (58%) said the same about the number of empty or derelict properties on their local high street.

Government response and regulations

With the prevalence of empty buildings on the rise, MFS’s survey found that over a third (34%) of UK adults feel that their local area suffers from there being too many run-down, empty or derelict properties. But how do they want the issue to be tackled?

In terms of more drastic measures, just over half (51%) of people think that landlords who own properties (residential or commercial) that have been empty for more than a year should be forced to sell them.

More moderately, there certainly appears to be a greater appetite for preventative measures. Some 61% of respondents agreed that stricter regulations should be brought in to stop people from leaving their homes vacant, or letting them fall into dereliction.

This is a sentiment that is shared by the Labour Party. Earlier this year, it laid out plans to allow councils to charge a 300% council tax premium on long-term empty properties.

The largest majority (67%) of people think that the government should do more to incentivise people to buy and renovate derelict, empty properties. This is supported by government-funded charity The Empty Homes Agency, which believes renovating and occupying these properties would not only be a partial solution to the country’s housing shortage, but a plus for the environment and local communities.

So, it is clear that if policies that encourage – rather than force – landlords and homeowners into getting their properties back onto the market are supported by the British public.

Reusing and regenerating Britain’s empty buildings

More than three in five (63%) UK adults think that putting empty buildings back onto the property market would be the most effective way of solving the UK’s housing shortage.

But what other ways would the public like to see empty buildings be put to better use? MFS delved deeper into this topic, quizzing respondents on what they would most be in favour of when it comes to conversions and/or renovations.

The full findings of this question can be found ordered in most to least favourable below:

Would you be in favour or opposed to the following ways that empty properties in your local area could be used? & Percentage of UK adults in favour of this

- To be made available as residential properties – more homes: 74%

- Remove the building and use the land to create green spaces (parks, playfields, urban farms, allotments): 68%

- Use the buildings for community and shared space: 66%

- Convert the properties into schools or nurseries: 59%

- More shops: 51%

- More hospitality venues: 51%

- Convert into recreational facilities like gyms or fitness studios: 47%

- More entertainment venues: 38%

Clearly, using empty buildings to create more homes (74%) proved to be the most popular option.

In second and third place are using the land to create more green spaces (68%), or keeping the buildings but repurposing them for community and shared spaces (66%).

Another popular option was to use empty buildings for schools or nurseries, which found favourability among 59% of respondents.

On the topic of ‘more shops’ and ‘more hospitality venues’, one in two (51%) respondents are in favour of these options, while less than half (47%) support the use of empty buildings as recreational facilities like gyms or fitness studios.

The view of our CEO

“The findings of our research underscore a crucial challenge for the public and private sectors – the British public are seeing the number of empty buildings in the UK grow, and innovative solutions to tackle the issue must be found.

“Clearly, communities across the UK would like to see more proactive government action, with respondents emphasising the need for incentives to encourage landlords and homeowners to reintegrate their vacant properties into the market. However, it is essential to acknowledge that the responsibility should not rest solely on the shoulders of the public sector.

“Indeed, with its own set of potentially more innovative capabilities, the private sector can – and must – significantly contribute to resolving this challenge. For example, there are sites and auctions entirely dedicated to finding abandoned property and guiding the purchasing process, making it easy for landlords looking to ‘flip’ an empty property to acquire a suitable investment project.

“Meanwhile, specialist lenders can provide the finance that investors need to carry out an auction purchase or renovate a property to get it up to scratch. Whether it is financing the acquisition of properties at auctions or funding the renovations required to bring these buildings up to standard, lenders must play a vital role in transforming abandoned properties into valuable assets and boosting the supply of homes in the UK.

“Looking to the future, the reintroduction of Britain’s empty homes to the market should be treated as more than a solution to the vacant building headache, but a catalyst for future transformation. Indeed, the revitalisation of these neglected properties has the potential to breathe new life into local communities, while the boosted supply of homes should contribute to creating a more equitable housing market.

“With our wide range of bridging loans and buy-to-let mortgages, MFS is eager and ready to assist investors looking to take on an empty or derelict property in the months and years to come.”

– Paresh Raja, CEO, Market Financial Solutions

Disclaimer

MFS are a bridging loan and buy-to-let mortgage provider, not financial advisors. Therefore, Investors are encouraged to seek professional advice.

The information in this content is correct at time of writing.