Business Development Manager – South

Meet…

Charlotte Parker

Business Development Manager

I’ve been working in the financial services industry for over 20 years, having started in the regulated space, then becoming a broker, before finally becoming a BDM within specialist lending for the last 6+ years. I truly enjoy every moment I dedicate to my brokers and their underlying borrowers.

I’m here to support southern brokers with a broad range of property investment strategies and assets – from MUFBs all the way through to semi-commercial opportunities. I know we’re in an unsteady market at the moment or at least, that’s what the press tells us. But I want you to rest assured, I’m here to talk through any concerns you have at length. Consider me your sounding board!

I want to hear from brokers who are truly open to collaboration. The more questions I can answer for you, the better. If you want to get the ball rolling and talk through any concerns you may have, I’m all ears.

Email: charlotte.parker@mfsuk.com

Phone: +44 (0)7855 205 573

“I am very approachable, easy to talk to and patient.”

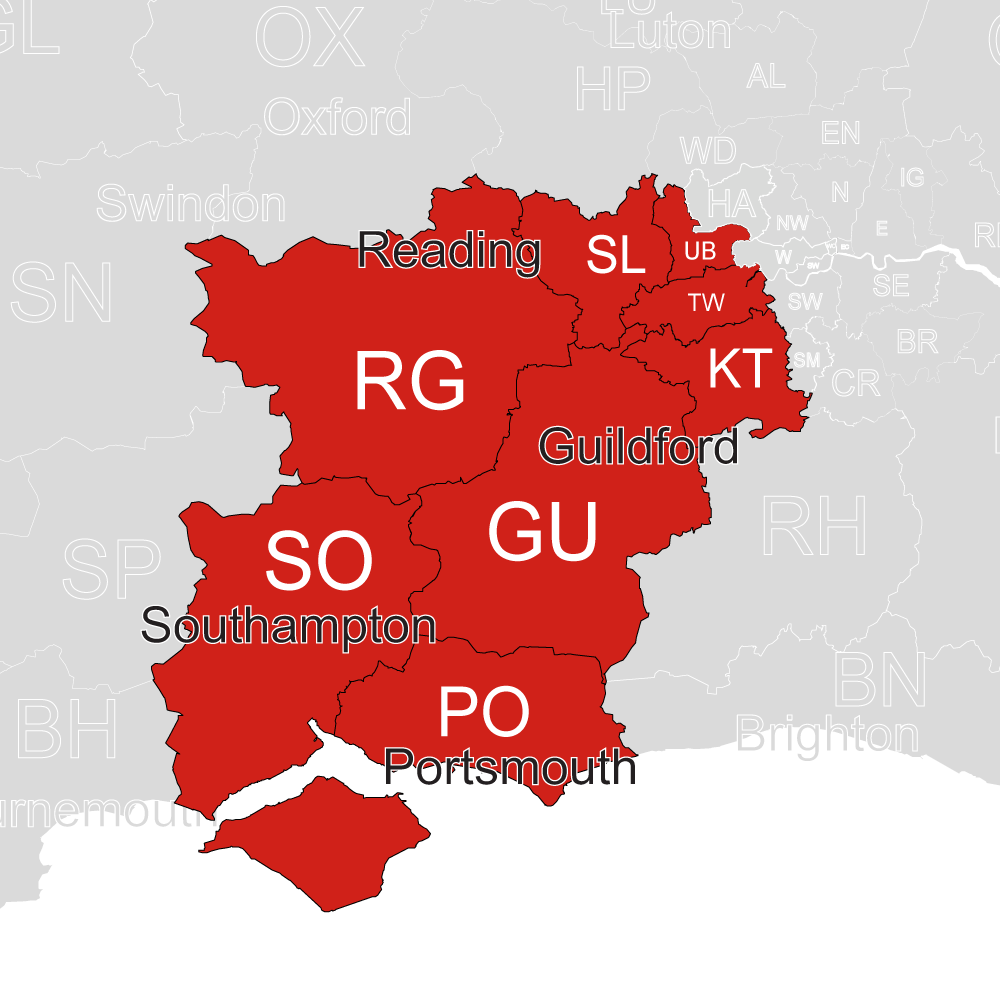

Regions I cover

I can help you with bespoke loans for Southern England investments. Specifically, this includes:

- Reading & Slough

- Southall

- Twickenham & Kingston upon Thames

- Guildford

- Portsmouth & Southampton

Contact me

Email: charlotte.parker@mfsuk.com

Phone: +44 (0)7855 205 573

Introducing Charlotte

Charlotte has the magic combination of being completely on her professional game when it comes to the property market, while also handling everything with a warm sense of humour. In between insightful analysis of the industry, there were bouts of laughter and banter.

Evidently, this serves Charlotte and her brokers especially well. It’s clear for those who work with Charlotte that her approachable nature brings out the best in everyone involved. Ultimately, it’s the underlying borrowers who benefit from this the most.

Looking ahead, there are plenty of shifts in the market looming that Charlotte is more than ready to handle, and share a joke or two on!

Interview with Charlotte Parker Market Financial Solutions’ BDM for Southern England

“How did I get into the industry? Oh, by mistake!”

Charlotte, if nothing else, is especially honest. Still, despite the accidental entry into the property finance world, she was never really too far away from it.

“I wanted a 9-5 job and I saw one advertised with Nationwide Building Society. I interviewed, got the job, but little did I know that 20 years later, I’d still be working in financial services!”

Market Financial Solutions embraces the highest levels of customer service and Charlotte is clearly willing to go above-and-beyond for her clients.

What do you enjoy about the specialist finance market?

Initially, Charlotte started moving into the world of specialist finance as she came up against some of the challenges that can emerge in the high street lending scene. In the early 2000s, Charlotte worked with intermediaries and eventually pushed into branches as she became CeMAP qualified.

“I guess I got to a point after nine years of being the mainstream market of being frustrated with having to say no,” she said.

“There were a lot of cases I couldn’t help with, which was very frustrating. I found myself referring people to unbiased brokers and that’s when I thought ‘I want to go and be that broker’, which is what I did!”

Having spent a few years as a broker, Charlotte found herself in the specialist market, which quickly proved its worth.

“In specialist finance, there is a lender out there for most scenarios. It enables brokers to field those cases that don’t fit the usual boxes. It’s a more interesting, more exciting industry.”

What is it that you offer to brokers that work with you?

‘’I am very approachable, easy to talk to and patient. Whether you’re an industry expert or recently qualified I hope you find me supportive, helpful and upbeat,’’ she said with a twinge of embarrassment.

“I’ve got quite a warm personality – I’m told – and it removes that kind of barrier, I guess, that can be there between brokers and their BDMs.”

By putting her clients at ease, Charlotte explained that it allows her brokers to take a step back and think through their case with a renewed, fresh perspective.

“Sometimes a broker will call me with an issue, with a problem, with a case, and actually I won’t know the answer immediately. But just by talking it through, at the end of a 15-minute conversation that broker will say to me ‘thanks for that’, and I have to point out that it wasn’t me who gave them that solution, they came up with it by themselves!

“Sometimes, it’s just about giving brokers a sounding board.”

It gets the job done. That’s the main thing.

What would you like to see introduced or prioritised within the specialist finance market?

Charlotte believes there could be much more focus on enhancing our knowledge through education in the specialist market.

“I think there are a lot of professionals out there who get caught up on writing business, and then you’re on that treadmill. Education can often take a backseat. We don’t know, what we don’t know, but the more you work to educate yourself the better you can be in helping your clients.”

Charlotte pointed out that with other professions such as nursing or dentistry, there is a requirement for ongoing training and development. We of course have CPD, and the LIBF have introduced a certificate for specialist property finance but Charlotte believes many property professionals don’t take all the opportunities that are open to them.

Where do you think there could be opportunity for property investors in the current market?

Charlotte’s career has evolved from the regulated side of things into specialist BTL, commercial, and bridging. She thinks this is also where the market has moved, or is heading to.

“I think there’s still a lot of potential in BTL. A lot of investors are looking at ways to increase their yields and they’ve done that with HMOs and MUFBs, but now they’re focusing on what might be next.”

In Charlotte’s opinion, this could involve leasing properties to local authorities, and/or pushing into the commercial space.

“But there will be a lot of investors who are not used to commercial, so they’ll dip their toe into a semi-commercial property. I think this presents a huge opportunity, and it’s a growing market.”

Are there any typical borrowers or cases that you tend to work with?

The pandemic somewhat dented demand for larger offices, but Charlotte has noticed an uptick in enquiries for smaller offices, the kind suited for flexible working practices.

“All these big empty office blocks, I think investors are going to go in and convert a lot of them into residential properties. I think that is another huge opportunity.”

What do you do to get your mind off the world of property finance?

It’s clear to see where Charlotte’s cheery disposition comes from.

“My daughter’s a Cub, and my husband’s a scout leader, so we’re often dropping off, picking up, putting up tents, going camping, going for walks, planting, and just getting involved really,” she said.

Her interviewer pointed out that growing up in South London didn’t allow him to engage with much camping.

“Get a fire pit,” came the reply. This, unlike Charlotte’s other responses, wasn’t followed up by any chuckling. It’s good to know that she is aware of when it’s the right time for utter seriousness.

Get in touch

If you have clients looking to expand in or are from Southern England, Charlotte is ready to hear everything you have to say, and then some.

Email: charlotte.parker@mfsuk.com

Phone: +44 (0)7855 205 573